Most Popular

Search This Blog

- First Paper

- _GK

- __Current Affairs

- _IQ

- _English

- Officer

- _Second Paper

- _Third Paper

- _Fourth Paper

- Computer

- _Officer/Engineer

- _Operator

- _Nepali Unicode

- _IT Skill Test

- _Tricks & Tips

- Assistant

- _Na.Su. (Level 5)

- _Kharidar (Level 4)

- Syllabus

- Recent Paper

- Notice

- _Vacancies

- _Exam Routine

- _Exam Center

- _Results

- Other

- _Online Tests

- _TSC

- _TU

- _RBB

- _Staff Nurse

- _Nepal Police

- _Myadi Police

How Vehicle Taxes Are Calculated In Nepal - Full Process Of Calculating Vehicle Tax Due Amounts

Although the vehicle tax rates of all states are different, the fines are the same. But some things are slightly different. For example, model tax is also levied on vehicles in Bagmati province, while model tax is not imposed in other provinces.

To calculate the amount of tax owed on any vehicle, we need to know these 3 main things.

1. Vehicle details

2. Rate of vehicle tax

3. Last tax paid and renewal date

First of all, what should be understood by the description of the vehicle, what kind of vehicle is the vehicle for which you are going to calculate the tax. Is it a private or public or is it a government institution or tourism. Similarly, the type of vehicle: motorcycle, car, jeep, van, bus, truck, etc. And the year the car was made, which is also known as the model: like 2010, 2016, what year is the model year. This model year is not required when calculating the tax of provinces other than Bagmati Province, but in Bagmati Province, if according to this model year, if the vehicle is manufactured 15 years from the year of manufacture, additional tax will be charged at the rate of 5% every year, so this model tax should also be charged. Then the capacity of the vehicle is how many cc is this vehicle's power. Because cc accordingly, there are separate tax rates for motorcycles and cars, jeeps and vans. You can easily find out all this by looking at the vehicle bill book that you have.

The rate of vehicle tax is constantly changing. And what we need to understand while calculating the tax is that the current fiscal year. The current tax rate is only for this financial year. For old years, tax and penalty will be charged according to the old tax rate at that time. Therefore, we need to know the vehicle tax rate of that vehicle for the number of years we have to calculate the remaining tax. You can also find posts about my vehilce tax rates tables on this site. Also, we can get the vehicle rates from before till now from the website of the transport department and from the Ministry of Economic Affairs of the respective province. You can download the rate table of Bagmati Province, compiled by me for all years, from the previous post of this site can found the link is related post.

Check Tax Rate Tables:

Then we need to know the last financial year tax paid and the last renewal date to calculate vehicle tax. This detail can also be known by looking at the vehicle registration book - bluebook that we have with us.

Now that we have this information, we can easily calculate vehicle tax by ourselves. To be more clear, let's take some 2-3 examples and calculate the vehicle tax.

Now take an example 1:

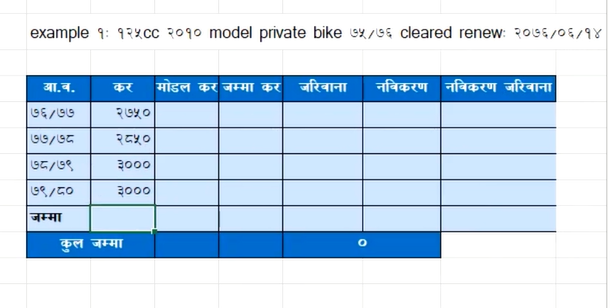

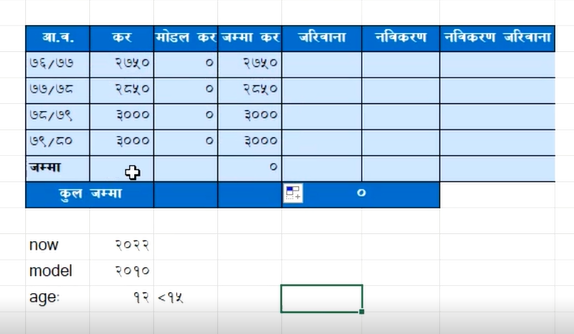

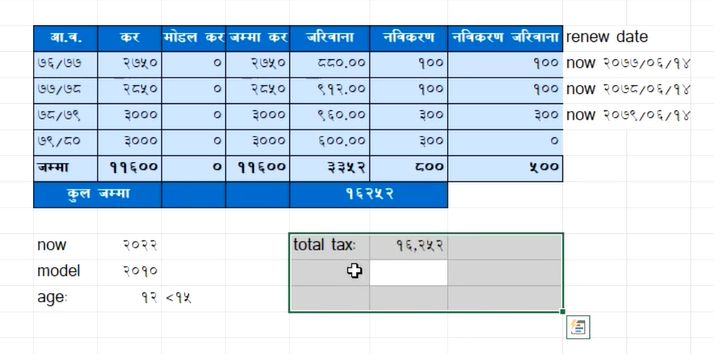

If 125 cc. of a private motorcycle built in 2010 has paid tax up to the financial year 075/076 and the last renewal date is 2076/06/14, then let's calculate how much tax it has to pay until today.

According to today's date, the current current fy 079/080, now we have to pay tax. 76/77, 77/78, 78/79 and 79/80 are 4 financial years.

We are going to calculate 125 C.C. Let's see how much is the private motorcycle tax from the table and put it in the tax column. Like this 125 cc falling 0-125 cc category. According to the category, the tax is 2750/- in 76/77, 2850 in 77/78, 3000 in 78/79 and 3000 in 79/80.

Now we have to pay attention to the model for in Bagmati province. If the year of manufacture of the vehicle reaches 15 years, additional vehicle tax is charged. So to see if the model tax is applicable or not, let's reduce the model year of the vehicle to the current English year 2022. The age of vehicle became 12yrs. After that, this car has not reached 15 years. So now there is no model tax on it, so let's keep all the zeros in the column of this model. Since this vehicle reaches 15 years after 3 years, model tax is charged after 3 years.

Then let's add this tax and model tax to this total tax.

Then, let's calculate how much penalty we got in this tax penalty column. According to the latest rules, now the vehicle tax penalty is no penalty if paid within 3 months from the renewal date of the bill book for the current financial year. And if the 3 month period expires, 5% will be charged, if 2.5 months later, 10%, and 2.5 months later, 20% will be charged. And if it exceeds the financial year, 32% penalty will be charged.

The renewal date of our motorcycle is 2076/06/14. It has been many years since this date passed, so we didn't have to think about it. Let's directly calculate 32% of the total tax of previous financial years. And for the current financial year it is 20%.

After that, let's put the renewal fee in this renewal column. 100 in all previous years but since 78/79 the renewal fee has been 300. And in this renewal penalty, 100% of the renewal fee will be charged after 3 months of the renewal date. Then for current fiscal year, in order to see if the penalty will not be charged, we have to add the previous year's total renewal payment to your last renewal date.

As we have paid this old 3 year renewal fee from 76/77 to 78/79 then adding 3 years to our previous renewal date of 2076/06/14 comes to 2079/06/14. Now this date is greater than today's date, which means this date is still not delayed for current year. So, no need to pay for renewal. But since 2079/06/14 will end in 1-2 months from now, you will have to go again in 2079/09/14 to renew. So let's pay this 300 renewal fee to renew for 1 more year now so that we don't have to go again in 2 months, but there is no renewal penalty, so let's zero the renewal penalty.Now the total outstanding vehicle tax that we have to pay is the sum of total amount of this tax, model tax, penalty, renewal and renewal penalty.

Let's take another example to understand further

If 220 cc. of private motorcycle built in 2018 has paid tax up to the financial year 078/079 and the last renewal date is 2079/04/25, let's calculate how much tax it has to pay until today.

The tax of this motorcycle has been cleared till 078/079 and now the rest is only for this current 079/080 financial year. Let's look at the motorcycle tax. 220 cc on 079/080 fy, it fell in the category of 151 – 225 cc. So its tax rate is 6500.

Then there is the 2018 model which is not yet 15 years old so model tax is not charged on it either. So model tax is zero.

And our last renewal date of 2079/04/25 was not even 3 months before the penalty was charged. Therefore, the penalty was zero.

Similarly, the renewal fee has become 300. Also, since the renewal date is less than 3 months, no renewal penalty was incurred.

Therefore, if this motorcycle goes to pay the tax within 3 months of the renewal date, the total tax will be 6500 + 300 for the renewal, and the total will be 6800 only.

Similarly, let's consider an old model car.

If 1500 cc of a private car made in 2005 has paid tax only up to the financial year 075/076 and the last renewal date is 2076/04/05, let's calculate how much tax will have to be paid till today.

As the tax of this vehicle has been paid up to 075/076, now till today 4 years of tax of 76/77, 77/78, 78/79 and 79/80 are yet to be paid. Therefore, in this financial year, 1500 cc. Let's see how much is the tax on a private car in the tax table.

According to this, the tax rate of this vehicle is 23100 in 76/77, 23500 in 77/78, 25000 in 78/79 and 25000 in 79/80.

Now since its model is 2005, additional model tax will be charged on it from the year it reaches 15 years. Friends, now this model tax is applicable only in Bagmati province. Not in other provinces. Therefore, this model tax does not need to be calculated when calculating the vehicle tax of other provinces.

Now in model tax 76/77 around 2019 this vehicle has reached 14 years so model tax is not charged until this year so it has zero. After that, the model tax will be increased by 5% every year. So 77/78 AD. 5% of tax is charged on , 10% on 78/79 and 15% on 79/80. The maximum tax rate of this model is 100%. 100% model tax is always charged in the following year without increasing by 5% after it reached it's maximum 100% model tax.

And the penalty is always on the total amount of tax + model tax. Therefore, the current current 32% tax + modal tax in all previous years except 79/80 and current year. A fine of 20% of tax + model tax was charged.

Similarly, the renewal fee for private cars is 200 from 78/79 and later it is 400 from 78/79.

Also, the old 3 fy in the renewal fine. It takes 100% and then the updated renewal date 2076/04/05 adding 3 years to 2079/04/05 has also passed from today's date so this current year. 100% renewal fee is also charged.

In this way, after all the taxes, model taxes, fines, renewals and renewal fines, this total amount is the tax amount that we have to pay.

In addition to this, if it is a public vehicle, then this vehicle tax will be charged as well as income tax. Similarly, even if it has been more than 5 years since the renewal failed, the re-registration fee and penalty will have to be paid again.

In this way, we can easily calculate the vehicle tax by looking at the details of our vehicle.

Most Popular

Lok Sewa Aayog Nepal Yearly Calendar 2080-081- वार्षिक कार्यतालिका

Tags

- 2081

- adbl

- alternative candidates

- annual working schedule

- assistant

- assistant 2nd

- Assistant Computer Operator

- bagamati pradesh

- barshik karyatalika

- computer

- current-affairs

- deputy secretary

- downloads

- english

- epf

- exam-center

- excel

- first class

- first-paper

- fourth-paper

- gk

- google input tools nepali

- health sector

- hetauda

- information

- iq

- ITSkillTest

- judicial service

- kathmandu

- kharidar

- kharidar first paper

- kharidar second paper

- kharidar third paper

- koshi pradesh

- level 4th

- level 5th

- microfinance

- myadi police

- na.su.

- nasu

- nea

- nepal police

- nepal telecom

- nepali keyboard

- nepali typing

- nepali typing unicode

- nepali unicode

- nepali unicode romanized

- nepali unicode typing

- new salary scale 2079

- non gazetted

- notice

- nrb

- officer

- officer 7th

- officer-engineer

- online-test

- operator

- permanent job

- rastriya Banijya Bank

- RBB

- Recent-paper

- recruitment

- results

- routine

- sahayek 5th

- sahayek computer operator

- sahayek prabandhak

- sakha adhikrit

- second phase exam

- second-paper

- section officer

- Staff Nurse

- sub-engineer

- syllabus

- technical

- third-paper

- tricks

- tsc

- TU

- typeshala

- unicode font download

- unicode nepali

- unicode nepali font download

- unicode nepali typing

- upasachiv

- vacancies

- written exam

- उपसचिव

Categories

- 2081 (1)

- adbl (1)

- alternative candidates (1)

- annual working schedule (2)

- assistant (3)

- assistant 2nd (2)

- Assistant Computer Operator (2)

- bagamati pradesh (7)

- barshik karyatalika (2)

- computer (10)

- current-affairs (4)

- deputy secretary (1)

- downloads (1)

- english (1)

- epf (1)

- exam-center (8)

- excel (1)

- first class (1)

- first-paper (7)

- fourth-paper (2)

- gk (6)

- google input tools nepali (1)

- health sector (1)

- hetauda (2)

- information (3)

- iq (1)

- ITSkillTest (3)

- judicial service (1)

- kathmandu (2)

- kharidar (22)

- kharidar first paper (2)

- kharidar second paper (1)

- kharidar third paper (1)

- koshi pradesh (2)

- level 4th (3)

- level 5th (6)

- microfinance (1)

- myadi police (1)

- na.su. (4)

- nasu (17)

- nea (1)

- nepal police (3)

- nepal telecom (1)

- nepali keyboard (1)

- nepali typing (2)

- nepali typing unicode (1)

- nepali unicode (5)

- nepali unicode romanized (1)

- nepali unicode typing (1)

- new salary scale 2079 (2)

- non gazetted (2)

- notice (146)

- nrb (3)

- officer (17)

- officer 7th (2)

- officer-engineer (1)

- online-test (3)

- operator (6)

- permanent job (1)

- rastriya Banijya Bank (1)

- RBB (1)

- Recent-paper (11)

- recruitment (5)

- results (47)

- routine (1)

- sahayek 5th (1)

- sahayek computer operator (2)

- sahayek prabandhak (1)

- sakha adhikrit (1)

- second phase exam (2)

- second-paper (3)

- section officer (8)

- Staff Nurse (1)

- sub-engineer (1)

- syllabus (11)

- technical (4)

- third-paper (3)

- tricks (5)

- tsc (1)

- TU (1)

- typeshala (1)

- unicode font download (1)

- unicode nepali (1)

- unicode nepali font download (1)

- unicode nepali typing (1)

- upasachiv (1)

- vacancies (75)

- written exam (9)

- उपसचिव (1)

0 Comments